Beware the 18%

For a lot of the last year, we’ve been focused on the evils of the 1%. The media has been filled with the exploits of the "Occupy" movement, and their emphasis on how 1% are keeping us down, harming the country, destroying the job market and much more. I’ve got a different number that I'd rather we focus on – the 18%.

As individuals and a society, we are slaves to the 18%.

I speak not of the wealthy vs the poor, but of our own budgets, and how much we spend just getting around.

It’s one of the numbers that surprises people the most when put in context – that the average American household spends 18% of its after-tax budget on transportation. That’s second only to housing. Food comes in at 12%, and health care at 6%. Just consider that for a minute – we spend 3 times more on transportation than health care.

With all the discussion given over to health care at the political and national level, would you believe it is such a relatively small part of the average budget? How much airtime do we give to the vast amount more we spend on getting around? Will we ever see a Presidential debate focused on transportation?

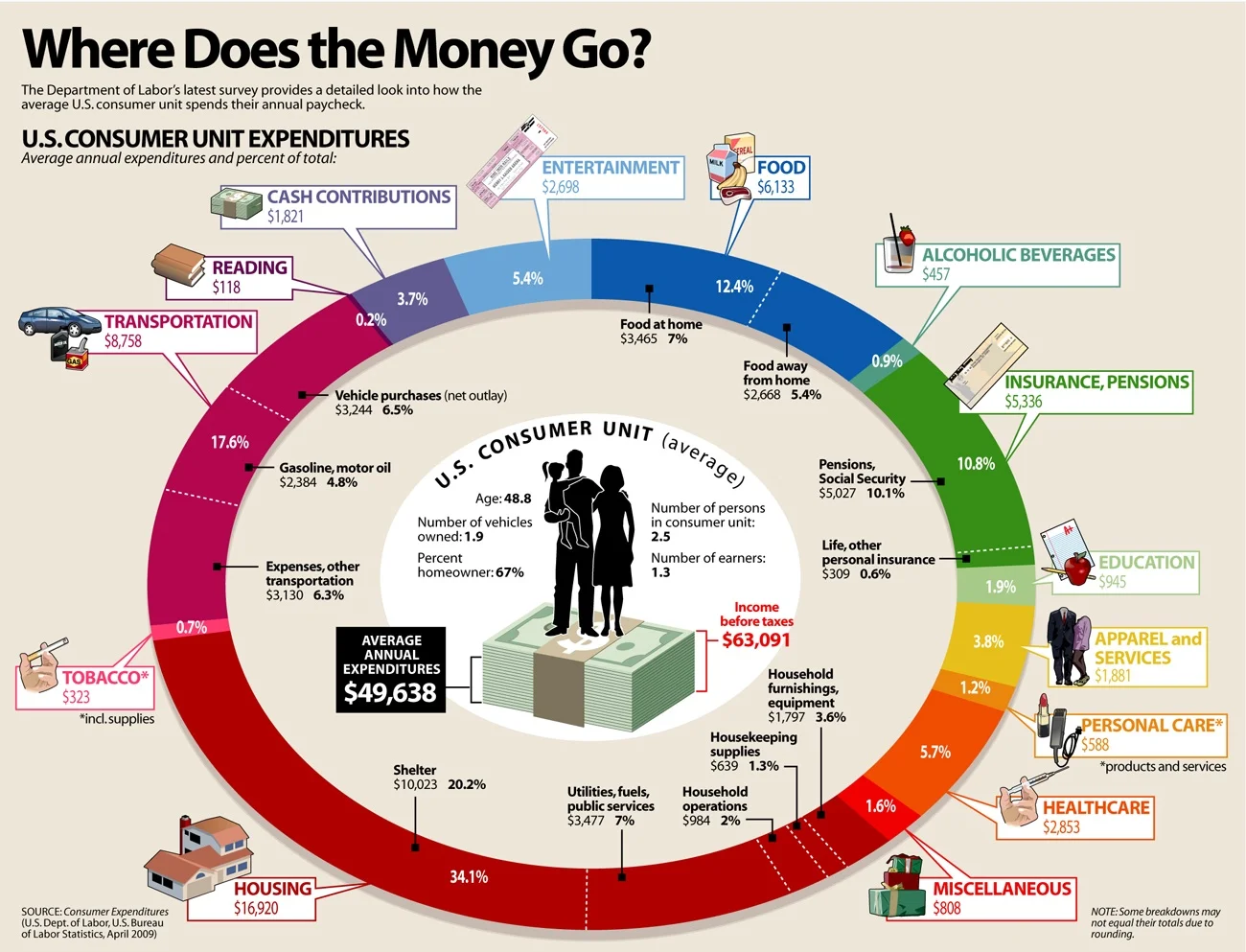

Where do these numbers come from? The latest information is from a Department of Labor survey from 2010. Here’s a fantastic visual chart of the information:

http://visualeconomics.creditloan.com/how-the-average-us-consumer-spends-their-paycheck/

Why do we pay so much? Very simply – because we are dependent on our cars to get us around. That’s why planners and urban designers like me use the phrase “auto-dependent” when referring to much of our cities and suburbs. In far too many places, it’s difficult at best to run the daily errands of life unless you are driving.

Digging deeper into the numbers, the AAA’s latest estimates (hardly a car-hating group) have the cost of owning a mid-size car at $9,519 per year, driving an average of 15,000 miles. Drive a bigger car, or more miles, and it’s higher than that. That number factors in all the necessary costs – average car payment, insurance, taxes, gas, maintenance, etc.

By contrast, the cost of walking is a pair of shoes. The cost of biking is a few hundred bucks a year for most riders. The cost of taking public transit is several hundred dollars (depending on your city), but still a fraction of car ownership.

Run the numbers on your own situation. For me, I currently don’t have a car payment, so I pay about 5% of after-tax income on transportation. But, since I have a car that’s 7 years old, I set aside money for large repairs and eventual replacement. When those are factored in, it comes to 12%. That’s still a high number, in my opinion. My goal is to have that consistently under 10%. Since I live in a place where I walk routinely, that’s a very doable goal.

I’m under no illusions that we can all suddenly ditch our cars, and walk everywhere – as I noted earlier, too many of our communities are not set up for that today. But what if you could reduce your car use, and walk/bike/take transit more? If you own one car, you likely can’t eliminate it, but you could certainly save 4 to 5 thousand dollars per year. What would you do with an extra $4,000 in your pocket?

If you are a multiple car household, what would happen if you could eliminate a car? Now you’re potentially talking savings of 10 thousand per year. Want that family vacation, or extra money for savings? There’s your ticket.

What would happen to our ability to pay for other items in our budgets if we spent even half of what we currently did on transportation (which incidentally would still be more than on health care).

Or, looking at it from another perspective, how much more easily could you maintain your current standard of living, on a reduced income? This is certainly the equation that’s worked well for me, as I detailed in my TedX Creative Coast presentation last week (link forthcoming). Reducing your household expenses has an amazing ability to provide for less stress, more leisure time and more disposable income.

More and more this sounds like a late-night infomercial – save money, live better!

Perhaps you can even join the legions of people embracing car sharing as a way of life. Zipcar, the leading provider (but by no means the only), has seen an increase in membership from 50,000 to over 600,000 in just the last 6 years. It seems more people, especially young people, are waking up to how much our enslavement to the car is costing us personally.

What’s your story? How much do you spend, and how much could you save? Can you join the growing movement to occupy your sidewalk, bike lane or bus?

If you got value from this post, please consider the following:

- Sign up for my email list

- Like The Messy City Facebook Page

- Follow me on Twitter

- Invite or refer me to come speak

- Check out my urban design services page

- Tell a friend or colleague about this site