In my continuing efforts to shed light on the actual demographics of the US, as opposed to media narratives, I'll be looking occasionally at different metro areas. Just for fun, I'm going to start with Forbes' list of Best 25 cities and neighborhoods for Millennials. Why? Because, why not? You have to start somewhere, and this one is as good as any.

Today I'm going to look at the #10 city on the list, San Diego. For now I will continue to use the 2010 census data set, since it seems to have the most reliable and highest quality information. If anyone has suggestions for a better data set, please message me - I'm very interested.

I'm approaching these from the standpoint of a simple question. Who are my potential customers and where are they? Let's look at real numbers to help discern this, not studies that start with biased assumptions and have questionable data. I'd like to eventually parse this data into much smaller sub-markets, but for now am just using city and metro to compare.

I also recognize that some of the best data out there are those produced by ESRI and Claritas. But for this exercise, I want to use what's freely available instead of what I can purchase. This is a more simplistic approach that any journalist or writer can easily perform.

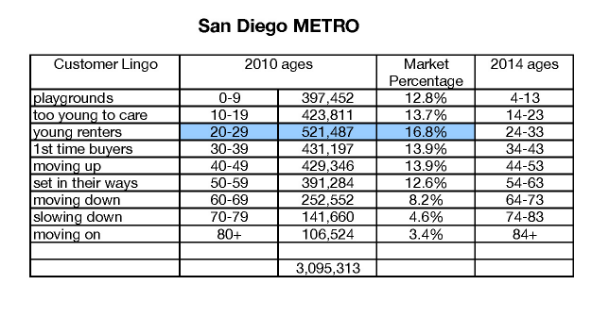

So, for San Diego, here's the population breakdowns by age.

I've highlighted the two age groups that clearly have the most people, though 40-49 is not far behind.

The 20-29 age group really stands out in San Diego, but 3 other age cohorts are essentially tied for 2nd.

So, what this all show?

Clearly San Diego skews younger than average. I doubt many of us would be surprised by that fact. It's location, great weather and proximity to Mexico all probably factor in to that.

But let's take this exercise now and make it real. I'm going to imagine that I'm a developer or a city leader that is intent on catering to the population of people that wants a walkable neighborhood. In order to do that, I need to understand the next level - where are they, who exactly are they and how do I target them? They're not all going to be 20-somethings, nor should they be.

Using this study (one of the better studies performed recently) I'm going to make a big leap to assume 50% of the region wants walkable and 50% doesn't. Of the 50% that want walkable, I'm going to further estimate (based on my experience) that about 30% of them want a true downtown life, and 70% want what I'd call "small town urban." For the latter, think primarily of houses and townhouses instead of primarily apartments and mixed-use buildings.

So by those numbers, I have 50% that want either suburban/exurban/rural living, 15% that want true downtown living and 35% that want small town urban. Those numbers I think change from region to region a bit, but they are good guideposts.

The 2010 census numbers have zip code 92101 (downtown San Diego) with a population of 37,095. So, just in the city of San Diego it only has 2.8% of the market. In the region that shrinks to 1.2%. One could make a strong case that downtown San Diego is dramatically under-performing in the market. At 15% of just the city market, it should have a population of 196,110. In terms of the region (which I think is the correct measure) it's obviously twice that. Great opportunities for attracting a true city center market abound.

The small town urban market is much more difficult to quantify since it would take a fair amount of study to determine which existing neighborhoods meet that criteria. But my educated guess would be that that market is under-performing as well, though probably not as much as downtown on a percentage basis. What I can say is that by looking at the regional market the approximate population of people who are customers for this sub-market is just north of one million people.

So, planners and urbanists, take your shots. Even in a city that skews young, you aren't going to find that many 20-somethings or baby boomers. And in point of fact, the "boomer" market is really not all that big. So, where will you find them? Perhaps it's time to look at those 30, 40 and young 50-somethings as well. Just keep in mind, they have different needs and desires.

If you got value from this post, please consider the following:

- Sign up for my email list

- Like The Messy City Facebook Page

- Follow me on Twitter

- Invite or refer me to come speak

- Check out my urban design services page

- Tell a friend or colleague about this site